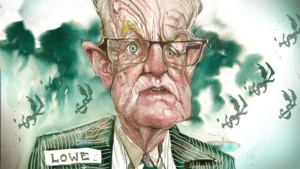

Home » Commentary » Opinion » Reserve Bank must be made accountable for inflation mistakes

· Financial Review

Both major political parties support an external review of the Reserve Bank of Australia (RBA) after the election. What should that review examine?

Both major political parties support an external review of the Reserve Bank of Australia (RBA) after the election. What should that review examine?

Media reports have focused on the RBA’s inflation target of 2 to 3 per cent. Some commentators argue for a higher target, some for a lower. Others propose replacing this target with a different variable, such as nominal GDP.

These questions are worth considering, but they are not the main issues facing the RBA.

For most of the past decade, the RBA has been unwilling or unable to attain its targets. Underlying inflation fell below 2 per cent for over five years – and would have done so for longer if not for the pandemic.

So resetting the target is beside the point. It is like a cricket coach telling a bowler which stump to aim at when the bowler can’t even land the ball on the pitch.

The central issues the review needs to examine are questions of governance. Why did the RBA persistently miss its target and how can that be avoided in future?

A major factor was that monetary policy targeted financial stability, often called “leaning against the wind”. The RBA claimed that low-interest rates would increase indebtedness and this would make household spending volatile.

This argument has multiple flaws. Contrary to what the RBA asserted, research finds that low-interest rates are about as likely to lower the debt-to-income ratio as to increase it.

Low rates increase net wealth and after-interest disposable income, and thereby reduce the sensitivity of household spending to shocks. And even in contrived worst-case scenarios, indebtedness has tiny effects on aggregate household responses to external shocks.

The RBA has a track record of analytical error compounded by resistance to review.

More serious than the analytical errors was the poor process. This argument about financial stability was never fully explained nor defended. The relevant research was not discussed. Counter-arguments were not addressed. There was no scrutiny.

So, even if the RBA was wrong (which it was) how would it find out? There is no process by which mistakes can be identified, let alone corrected. So the mistake persisted.

And this is not an isolated example. The RBA has a track record of analytical error compounded by resistance to review.

Paul Keating recently pointed out the Reserve Bank’s culture of indolence. It has repeatedly responded too slowly and weakly to emerging problems.

Perhaps the RBA’s most egregious mistake was its targeting of the current account deficit in the late 1980s. Warwick McKibbin, then on the staff, was pushed out when he tried to criticise this policy.

One partial remedy would be to appoint more monetary policy experts to the RBA Board. Most current board members are non-economists who do not have the training to ask: “But governor, doesn’t the research say the opposite?”

Having board members capable of challenging the governor is important, but not enough. They also need an incentive. This means individual accountability and identified votes. Board members should publicly explain their views on policy, and where they agree and disagree.

At present, decisions are by “consensus”. This is undoubtedly comfortable for the governor, who has his decisions rubber-stamped. However, consensus stifles innovation. It promotes groupthink, insularity and status quo bias – leading complaints about the RBA.

Greater scrutiny of RBA decisions should not be purely an internal matter.

The Bank would make fewer and less persistent mistakes if it was more transparent. The country’s wisdom on monetary policy is not confined to Martin Place.

A transparent and accountable central bank would fully explain its decisions. But that does not happen. Minutes and statements following board decisions rarely discuss the pros and cons of alternative choices. The expected consequences from alternative paths for interest rates are not estimated, or even discussed.

A transparent and accountable central bank would also explain unsatisfactory outcomes. Where is the Bank’s explanation for why it persistently missed its inflation target?

Dwelling on errors is often uncomfortable and embarrassing, which is presumably why the RBA does not do it. But learning from mistakes is in the public interest, so quantitative post-mortems should be required.

In summary, RBA decisions need more scrutiny. This can be achieved by appointing more experts to the RBA Board, making Board members individually accountable and requiring greater transparency.

Reserve Bank must be made accountable for inflation mistakes