Home » Commentary » Opinion » Alan Kohler’s The Great Divide: Australia’s Housing Mess and How to Fix It

· QUARTERLY ESSAY

Comment by Peter Tulip

Public discussion of housing policy suffers from undisciplined eclecticism. Too many commentators provide long, unstructured lists of multiple causes or conclude that the truth lies in-between competing explanations. This muddle reflects an inability or unwillingness to distinguish the important from the unimportant. Alan Kohler’s Quarterly Essay The Great Divide and the accompanying media coverage are examples.

Instead, let’s be clear.

Housing costs are high and rising because growing demand interacts with unresponsive supply. This has been going on since at least the 1970s.

Rising demand in turn reflects higher population, higher per-capita income, and (since their peak in the 1980s) falling real mortgage rates. As discussed below, taxes are not an important factor.

Unresponsive supply largely reflects zoning restrictions. If the housing market worked like other consumer goods markets,higher demand would have resulted in many more dwellings. Instead, restricted supply has resulted in soaring prices.

Alan Kohler gets much of this right. His analysis of the dimensions of the problem and how it is ripping the social fabric apart is readable and incisive. And his discussion of zoning restrictions is spot on. As he notes, zoning is estimated to have raised the price of housing in our biggest cities by hundreds of thousands of dollars. Those estimates are in line with an enormous body of research. (Full disclosure: Kohler cites my research on zoning approvingly).

Kohler covers a wide range of other issues. I confine my comments to my biggest concern: his over-emphasis of tax concessions. He argues that the interaction of negative gearing with discounted capital gains taxes is a major reason housing is unaffordable. There is no credible research supporting this claim.

On the contrary, good researchers have estimated the effect of negative gearing and capital gains tax concessions on housing prices using different approaches and repeatedly found this effect to be tiny.

In summary, negative gearing and the capital gains discount are estimated to boost house prices between 1 and 4%, while having a smaller negative effect on rents. Most of these estimates represent a long-run ‘one-off’ effect that would have been incorporated into housing prices decades ago.

It does not require technical research to see that the tax concessions are unimportant. Kohler points to the acceleration in prices after capital gains were discounted in 1999. However, the logic of that argument would imply that prices should have fallen by twice as much following the introduction of capital gains tax in 1985. Instead, prices rose. Taxes on investor housing were much lower in the early 1980sbut prices were lower.

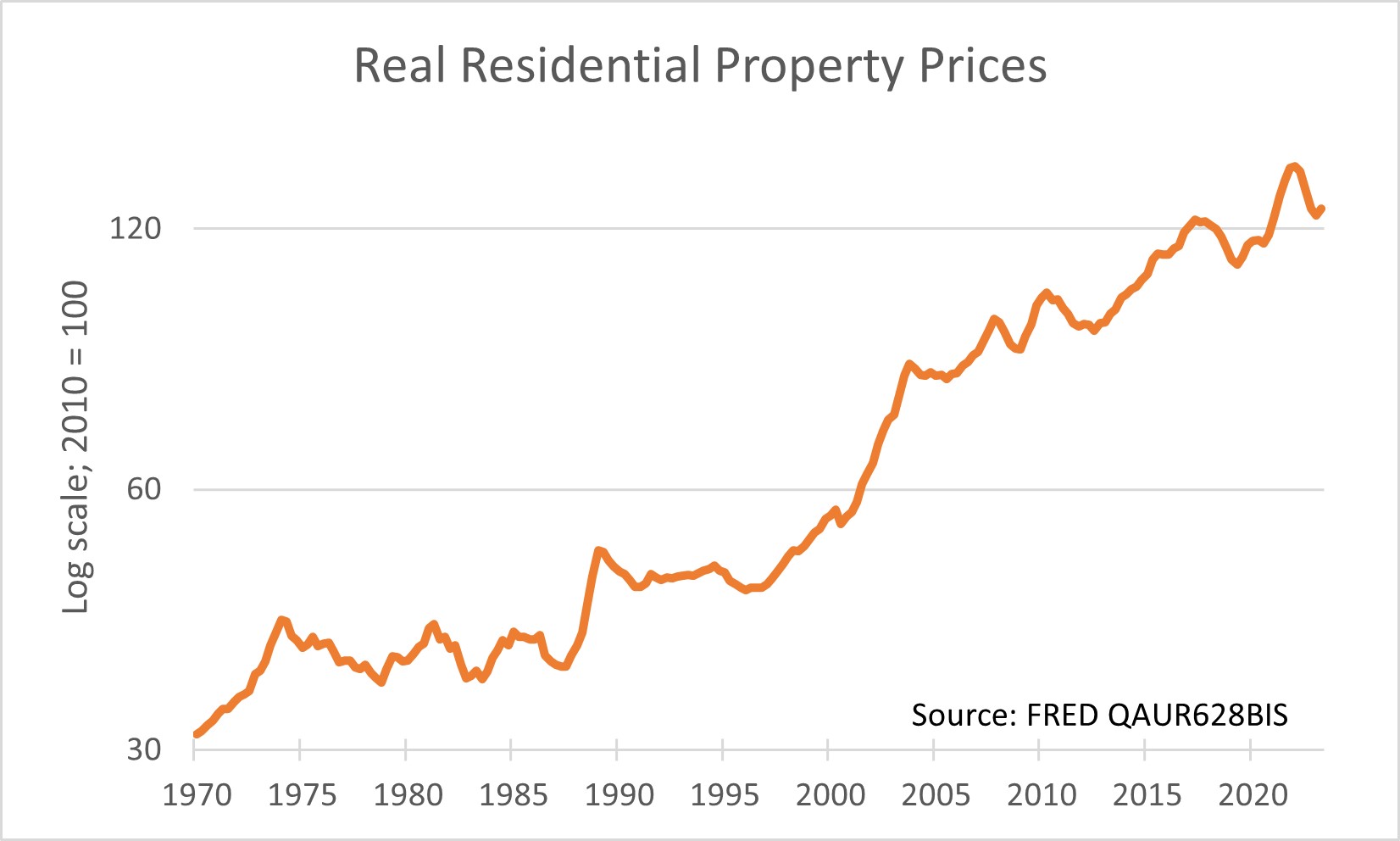

The evidence Kohler provides for a large effect of the tax concessions is a chart showing housing prices acceleratedafter 1999. That chart uses an arithmetic scale, which exaggerates the change. If instead, one plots house prices on a log scale — as is standard for variables subject to exponential growth — an acceleration can be seen but it is not dramaticand it begins before the tax change.

Empirical studies of housing prices (Saunders and Tulip, 2019; Abelson and Joyeux, 2023) attribute the faster recent growth to lower real mortgage rates and higher immigration. They give no role to tax concessions.

The fundamental problem underlying the housing crisis is that voters oppose more housing in their neighbourhood because they don’t know — or don’t care — about the harm this opposition does. That needs to be explained to them. Alan Kohler’s discussion of zoning restrictions and their effect on Australian society is very good in this respect. However, public education also requires paying attention to the researchand not being distracted by unimportant side-issues.

References

Abelson, Peter and Roselyne Joyeux, “Housing Prices and Rents in Australia 1980-2023: Facts, Explanations and Outcomes” (September 21, 2023). TTPI – Working Paper 14/2023 September 2023, https://ssrn.com/abstract=4591845

Cho, Yunho, Shuyun May Li, and Lawrence Uren (15 October, 2023) “Investment Housing Tax Concessions And Welfare: A Quantitative Study For Australia” International Economic Reviewhttps://onlinelibrary.wiley.com/doi/full/10.1111/iere.12673

Daley, John, Danielle Wood and Hugh Parsonage (2016), “Hot property: negative gearing and capital gains tax reform”, Grattan Institute https://grattan.edu.au/wp-content/uploads/2016/04/872-Hot-Property.pdf

Deloitte Access Economics (2019) “Analysis of changes to negative gearing and capital gains taxation”https://cdn2.hubspot.net/hubfs/2095495/_Communications/NGCGT/DAE%20analysis.pdf

Saunders, Trent and Peter Tulip (2019) “A Model of the Australian Housing Market”, Reserve Bank of AustraliaResearch Discussion Paper, 2019-01. https://www.rba.gov.au/publications/rdp/2019/2019-01.html

Tunny, Gene (2018) “Untangling the Debate Over Negative Gearing” Policy Vol. 34 No. 1, Autumn 2018 https://www.cis.org.au/app/uploads/2018/03/34-1-tunny-gene.pdf

Peter Tulip is Chief Economist at the Centre for Independent Studies. He previously worked at the Reserve Bank of Australia and the US Federal Reserve. He has written several research papers on Australian housing policy.

Alan Kohler’s The Great Divide: Australia’s Housing Mess and How to Fix It