Home » Commentary » Opinion » Come on Treasury, time doesn’t stand still

· Ideas@TheCentre

Treasury’s flawed tax model has led to the government’s structural reforms being estimated to cost much more than they actually will, and scheduled much later than they should be.

Treasury’s flawed tax model has led to the government’s structural reforms being estimated to cost much more than they actually will, and scheduled much later than they should be.

In Jumpstart Productivity: New modelling pinpoints better tax cut program, the impact of the tax reforms is calculated using a new dynamic model that accounts for behavioural changes, rather than the government’s static model — which assumed people do not respond to incentives.

The modelling shows that the long-term structural tax cuts planned for 2022 and 2024 are much cheaper than expected.

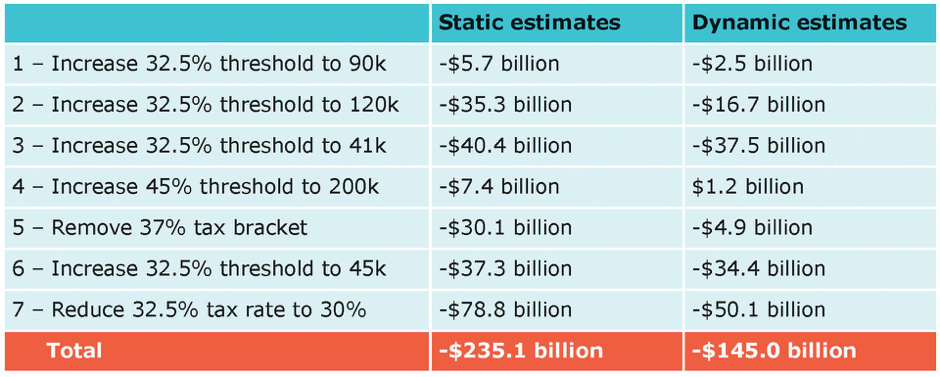

Instead of the expected revenue cost of $235 billion (excluding LMITO), over 10 years, dynamic analysis shows that they will have a much lower revenue cost of $145 billion over 10 years, which is 38% less than the government’s static estimate.

The benefits of these changes are significant, with GDP expected to increase by $36 billion/year and economic efficiency to improve by $13 billion/year, flowing on to higher wages and more jobs — and these benefits are over and above the direct financial benefits received by taxpayers.

The government should bring forward those changes from 2022 and 2024 to start next year, and can do so without threatening the budget surplus.

Three options for bringing the tax reform forward are outlined in the table below, alongside the Treasury’s own budget surplus estimate.

The structural tax cuts would replace the Low-Middle Income Tax Offset (LMITO), which does nothing to improve economic efficiency, and will cost the budget about 10% more than expected.

Further, all future federal governments should follow the lead of the UK Treasury in using dynamic tax analysis to give accurate information on economic efficiency and revenue estimates.

Come on Treasury, time doesn’t stand still