The Centre for Independent Studies (CIS) welcomes the opportunity to respond to Transgrid’s Material Change in Circumstance (MCC) Assessment Report for HumeLink.

The CIS is a leading independent public policy think tank in Australia. It has been a strong advocate for free markets and limited government for more than 40 years. The CIS is independent and non-partisan in both its funding and research, does no commissioned research nor takes any government money to support its public policy work.

We are writing to raise our concerns regarding the HumeLink project, particularly the cost benefit analysis in the MCC assessment and its significant increase in gross market benefits. The recent updates and discrepancies demand a transparent and thorough explanation to ensure stakeholders understand the implications and rationale behind continuing with HumeLink despite the apparent cost blowouts.

- Opaque and inconsistent market benefits modelling: The7x increase in net economic benefits since the PACR and 3.4x increase since the Draft 2024 ISP demand a detailed and transparent explanation of the increase in Transgrid’s projection of HumeLink’s market benefits — which the MCC currently fails to do.

- Failure to disclose and consult in accordance with procedure: The decision to delay the Material Change in Circumstances (MCC) Assessment until after submitting the Stage 2 Contingent Project Application (CPA) contravenes the National Electricity Rules (NER) and AER directives. This deviation not only breaches the procedural integrity required for such assessments, but also raises significant concerns over the transparency and accountability of the process.

Opaque and inconsistent market benefits modelling

The total cost for delivering HumeLink, as disclosed by Transgrid, escalated from $3.3 billion (June 2021 dollars) to $4.88b (June 2023 dollars), marking a $1.15b increase (or +31%) in June 2023 dollar terms since the publication of the PACR Addendum in December 2021.[1] Given that the net present value (NPV) of HumeLink in the Step Change scenario was $408 million (June 2023 dollars),[2] a $1.15b increase in real costs would presumably make HumeLink’s NPV negative and result in a material change in circumstances.

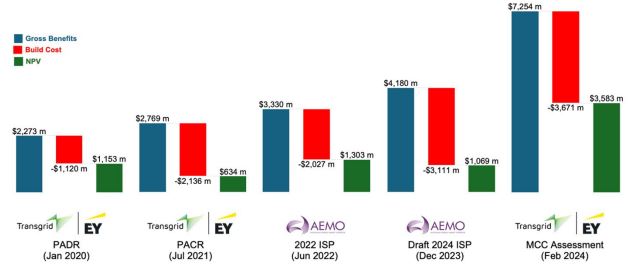

The 7.7x increase in NPV to $3.58b under TransGrid’s revised estimates is therefore a shock. It is also more than triple the $1.07b NPV estimated by AEMO in the Draft 2024 ISP via the ‘TOOT’ analysis.[3] As EY notes in their Gross Market Benefit Assessment of Humelink, the significant difference in net economic benefits cannot simply be attributed to “the three-year difference in commissioning date and outlook period”[4] from the Draft 2024 ISP.

Figure 1. Successive changes in HumeLink’s Step Change scenario NPV[5]

EY’s Gross Market Benefit Assessment of HumeLink estimates a total discounted market benefit of $7.25b=, 74% more than the Draft 2024 ISP, and 161% more than the same model in the PACR. This significant change brings into question the reliability of the entire assessment.

EY provides a number of reasons for the difference between the gross market benefit outcome of their model and the outcome in the Draft 2024 ISP:

- EY’s reason: The model in MCC Assessment includes more network detail in Southern New South Wales, capturing key transmission limits and losses, facilitating a direct comparison to the HumeLink RIT-T assessment.

- Our response: While additional detail is appropriate for distinguishing between options, assuming that the ISP’s simplifying assumptions are reasonable, it should not contribute significantly to gross market benefits nearly doubling. If it does, it brings the assumptions of the ISP or the EY model into significant question.

- EY’s reason: Different assumptions regarding the timing of transmission projects between the TOOT analysis and MCC assessment, affecting commissioning dates for several key projects like the Central West Orana and New England REZ Transmission Links, Project Marinus, and VNI West.

- Our response: While these differences have been transparently listed, the report fails to justify why they should be changed; given the requirement to stick as closely as possible to the ISP parameters, which are defined as including “other ISP projects associated with the optimal development path”.[6] Either these changes should be so minor as to not affect the outcomes, or significant as to warrant a clear explanation of why they are required.

- EY’s reason: Variations in the treatment of REZ transmission upgrades, particularly for the South-West NSW and Wagga Wagga REZs, where the TOOT analysis and the MCC assessment diverge in assumptions about transmission build associated with HumeLink.

- Our response: The freedom for the model to adjust, expand, reduce or remove other transmission projects is an extremely significant degree of freedom for the model. Given the requirement for RIT-T proponents to adopt ISP parameters, including other ISP projects, it is clear this divergence in method is not justified.

- EY’s reason: Structural differences in the modelling approach, with the MCC assessment computing an hourly build and dispatch solution for generation, storage, and transmission as a single solution, in contrast with the ISP’s multi-stage approach.

- Our response: Structural differences seem most likely to account for the huge increases in the gross market benefits, yet they are neither explained nor justified as appropriate divergences from ISP modelling. In particular, the treatment of contingency reserves — and the degree to which these are effectively ‘hard’ constraints or priced to penalise breaches, and whether storage contributes to reserves — significantly impacts the degree to which the model might become ‘overfit’ due to the perfect-foresight modelling. Failure to align this modelling behaviour with that of the ISP makes it impossible to draw any conclusions about a comparative cost-benefit analysis.

We consider the EY reasons offered above insufficient to justify the size of the change in gross market benefit, and insufficient to justify the divergence from the ISP parameters and modelling.

Delayed compliance with procedures

Transgrid’s decision to delay the MCC assessment until after submitting the Stage 2 CPA contravenes clause 5.16A.4(t) under the NER; which was in place at the time the CPA was lodged. The delayed MCCA also contravenes the AER.[7] Such action undermines the RIT-T process and transparency expected in the evaluation of significant infrastructure projects like HumeLink.

Transgrid’s failure in complying with the NER and AER’s written request to promptly publish a MCC assessment, whether intentional or not, has the effect of ensuring that:

- Market benefits could be maximised by using the amended 2023 IASR inputs published alongside the Draft 2024 ISP, particularly the 660 MW constraint on Snowy Hydro in the absence of HumeLink and new 2200 MW rated power.

- Stakeholders were left effectively unaware of the possibility of a material change being assessed as a consequence of the cost increases. This was exacerbated by the Regulator’s decision not to publish the CPA as soon as practicable following its submission, as required by NER 6A8.2(c), despite the CPA being foreshadowed to be lodged immediately on receipt of the Feedback Loop.

- There is now no credible way in which feedback from the MCC assessment could be incorporated into the CPA, which has already been lodged. This severely degrades the credibility of the consultation process.

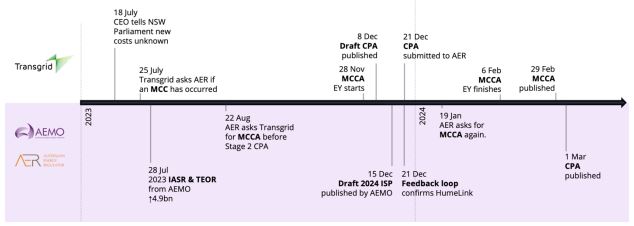

Figure 2: Timeline of events surrounding the MCCA

The CEO of Transgrid previously testified before the NSW Parliamentary Committee on the 18 July 2023 that the cost of HumeLink has increased by around 30%, while confirming a nominal dollar figure that would be closer to 50%.[8] A week later, on 25 July, Transgrid wrote to AER asking if Transgrid needs to assess if a ‘material change in circumstances’ occurred in light of the cost escalation, as mentioned in AER’s correspondence to Transgrid. We note this inquiry is not publicly available, and request Transgrid to make their inquiry available to the public.

AER responded to TransGrid’s inquiry confirming that they should do so promptly:

Transgrid should determine whether there has been a material change in circumstances as soon as possible. We consider it necessary that Transgrid make the ‘material change in circumstances’ assessment available to the AER and stakeholders, before it submits a further contingent project application to the AER[9] (emphasis added)

Despite this, Transgrid completed their MCC assessment on 29 February 2024, nearly six months later. In addition, they submitted their Stage 2 CPA on 21 December 2023, 70 days prior to completing the MCC assessment; directly contradicting AER’s directive that the NER required Transgrid to supply evidence of the MCC assessment prior to a CPA. This led AER to issue another notice to Transgrid on 19 January 2024, warning Transgrid that the CPA is at risk of being non-compliant for not lodging the MCC assessment before submitting the Stage 2 application.[10]

In the August 2023 Determination, the AER specified that: “it is our expectation that

Transgrid will more consistently, transparently and meaningfully engage with its stakeholders

and the wider community for the remainder of the HumeLink project.”[11] We believe Transgrid’s delay in complying with the NER ultimately diminishes the opportunities for meaningful consultation and fails to reach this standard.

In the present circumstance, there appears to be no opportunity for the CPA to be modified in response to feedback from the MCCA, and also no practical opportunity for stakeholders to consider and respond to any responses to issues raised in consultation prior to the close of submissions on the CPA.

In conclusion, we believe these significant problems mean this assessment does not provide the “supporting information necessary to demonstrate that the preferred option identified remains the preferred option.”[12]

Endnotes

[1] We note that the cited figure of “$3.27 billion (June 2021 dollars) assumed for Option 3C at the time of the PACR Addendum” in the MCC assessment is incongruent with the $3.3 billion reported on page 2 in the PACR Addendum. Accordingly, the MCC assessment’s estimate of a “cost increase of $1.06 billion” is understated. We further note that the 1.17 escalation factor adopted by Transgrid differs from the 12.5% increase in Australia CPI between June 2021 and June 2023; see footnote 2 below.

[2] Derived by discounting the project’s forecasted cash flows, as detailed in the PACR Addendum, in real 2021 dollars at a 7% discount rate. The figure was then adjusted to real 2022/23 dollars using the Australia CPI (ABS Series ID A2325846C). This inflation adjustment mirrors the method utilised in the PACR to adjust inputs to real 2020/21 dollars.

[3] Draft 2024 ISP, Appendix 6: Cost Benefit Analysis, p 41.

[4] Gross market benefit assessment of HumeLink report, February 2024, p 33.

[5] PADR reported in June 2019 dollars. PACR and 2022 ISP reported in June 2021 dollars. Draft 2024 ISP and MCC assessment reported in June 2023 dollars.

[6] NER 5.10.2

[7] AER, Advice to Transgrid in relation to material change in circumstances provisions, letter dated 22 August 2023.

[8] Feasibility of undergrounding the transmission infrastructure for renewable energy projects, NSW Parliament, 18th July 2023.

[9] AER, Advice to Transgrid in relation to material change in circumstances provisions, letter dated 22 August 2023.

[10] AER, RE: Notice under clause 6A.8.2(h1) of the National Electricity Rules, letter to Transgrid dated 19 January 2024.

[11] AER, AER Determination: HumeLink Early Works Contingent Project, August 2023, p vi.

[12] NER v207, 5.16A.4(o2)(1).